Our public service loan forgiveness calculator (PSLF) does the following:![]()

- It helps you determine how much you’d save by going on PSLF relative to paying off your loans in 10 years. In short, what is the “benefit” of PSLF in your specific situation?

- Our public service loan forgiveness calculator also helps you come up with a game plan in case you do not get your loans forgiven in 10 years. This happens a lot because many people stop working at a non-profit within 2 – 4 years.

Public Service Loan Forgiveness Calculator Table Of Contents

- Step 1: Build Your Profile

- Step 2: Enter Your Loan Details

- Step 3: Access The PSLF Calculator

- Step 4: Entering Assumptions

- Step 5: Comparing PSLF To The 10 Year Loan

- Step 6: Your Estimated Maximum Benefit

- Minimizing Your Risk

- Implementing Your PSLF Plan

Step 1: Build Your Profile

To use our PSLF calculator, simply sign-up for our FREE FitBUX Membership. To do so you can use this link: Become A FitBUX Member. You become a Member because our tools and calculators are customized to your situation. Also, Members have the ability to schedule a free call with one of our expert student loan planners.

The profile should only take 3 – 5 minutes to create. The more details you include the more accurate our tools will be.

Step 2: Enter Your Student Loan Details

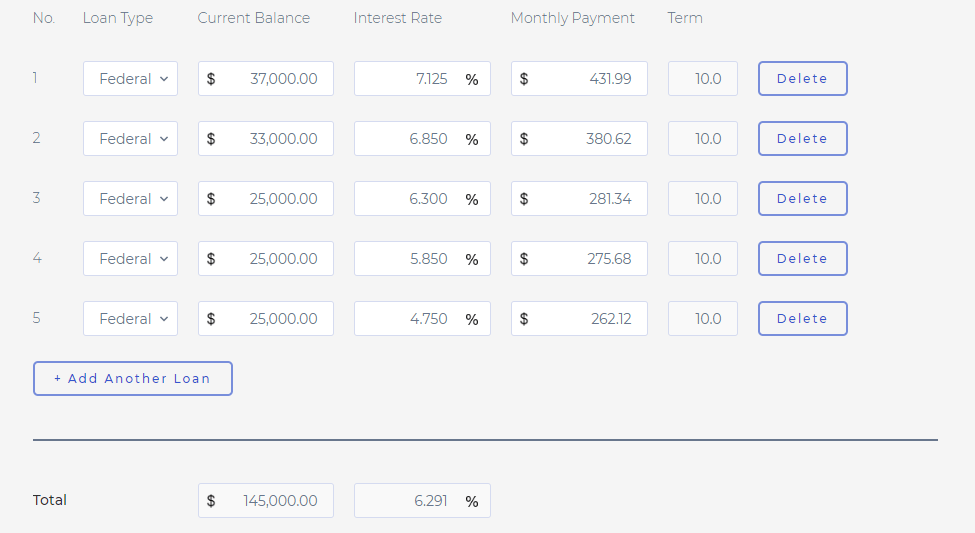

This is extremely important because each loan you have has a different interest rate. Therefore, the interest charge varies for each loan.

The results will be different in the public service loan forgiveness calculator if put all you loan details into your profile relative to if you use one large estimate of the loan balance and interest rate.

After you build your profile you will be taken to your FitBUX dashboard. Take the following steps to enter your loan details:

- Click “Net Wealth” on the left-hand menu.

- Then select “Debt.”

- Click the pencil icon next to next to “My Federal Loans”

- Enter your first loan. Then click “Add Federal Student Loan”. Repeat until all your loans are included.

- Click the “Save” button. Your loans are now stored in your FitBUX Profile and will be used by our calculators.

Step 3: Access The PSLF Calculator

On the left hand side of your profile, click the link that says “Tools.” Then select the tool titled “Should I Consider An Income-Driven Repayment Plan?”

Step 4: Entering Assumptions

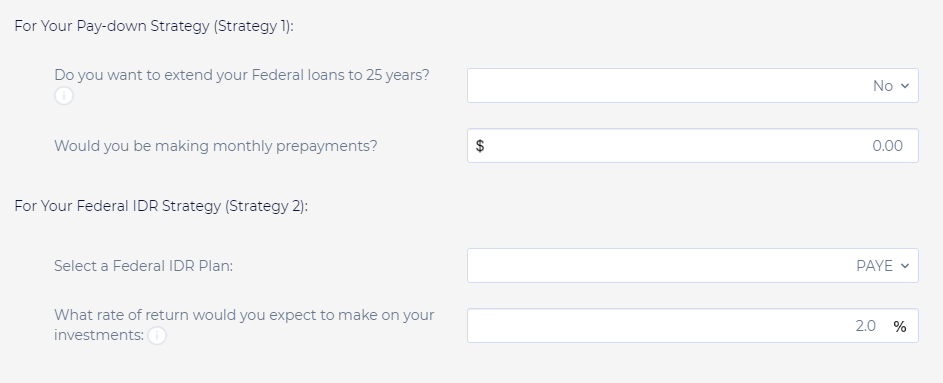

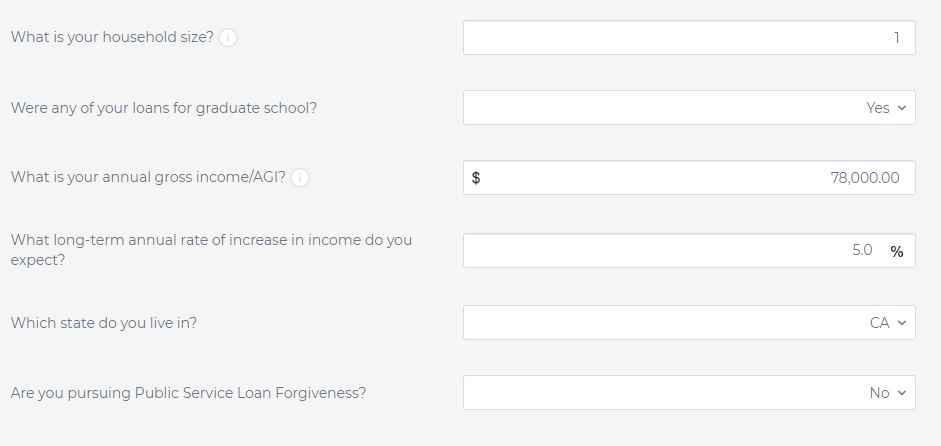

Once you enter the tool, you’ll be asked to set a couple of assumptions. These assumptions are extremely important as they will significantly impact the results and associated recommendations. The assumptions cover your household size, your AGI and lastly, your long-term annual rate of increase in income.

Household size: Your household size includes you, your spouse, and children.

For the question, “What is your annual gross income/AGI?” you can use one of two numbers:

- Gross income: This is how much money you make before deductions. You would want to use this figure in the calculator if you are trying to keep it simple and deciding if you’d like to pursue loan forgiveness or do a pay-off strategy instead.

- Adjusted Gross Income (AGI): Using AGI will result in a more accurate estimation. The reason being is the government actually uses your AGI in the calculations for your monthly payment, not your gross income. AGI is also called “Discretionary Income”.

For your expected long-term annual rate of increase in income, we default to 5% since Federal government’s calculator uses this value. However, we believe that 5% is a very aggressive assumption for most non-profit jobs. We recommend reducing the rate of increase assumption and choosing a range between 2% – 3%.

The last question on this screen is where you select that you are pursuing PSLF.

After imputing these assumptions, click the “Next” button and proceed to the loan details screen. There you can either confirm your loans are correct (i.e. you’ve already entered them into your profile) or you can enter each individual loan if you haven’t already done so.

After you enter/confirm your loan details, scroll to the bottom of the public service loan forgiveness calculator and click the Continue button.

Step 5: Comparing PSLF To The 10 Year Loan

The next screen will show you the various income driven repayment plans and an estimation of cost over 10 years.

To compare how much you save relative to paying off your loans in 10 years, scroll to the bottom of this screen.

Our public service loan forgiveness calculator allows you to incorporate this into your analysis. The expected rate of return question allows you to customize the rate of return. If you are unsure of what rate to put their, we recommend the risk free rate of return which currently is about 3.0%

Step 6: Your Estimated Maximum Benefit

On the top of the next screen, you’ll see two columns. On the left side is how much money you’d have after 10 years on the standard 10 year loan. The right side illustrates how much money you’d have if you used PSLF and saved the money you weren’t paying on the standard 10 year loan.

The difference between these two is the maximum benefit of PSLF.

From there you can scroll down and see the results on a chart so its easy to compare the two strategies side-by-side.

Minimizing Your Risk

We’ve helped new grads manage and eliminate over $1.4 billion in student loans. The number one risk we see for those pursuing PSLF is not getting the loans forgiven.

However, it’s not because of the government. It’s because they leave the non-profit to work at a for profit company within 2 – 4 years.

If this is the case you are on an income driven repayment plan. Therefore, you still qualify for forgiveness but it will happen in 20 or 25 years and now you have to pay the IDR tax.

Therefore, to minimize the risk of PSLF, you have to assume you will not get your loans forgiven in 10 years. Another way of thinking about it is that you must save for the tax as if PSLF doesn’t exists.

Then if you leave the non-profit, you should already be on pace to save for the tax or you’ll have the ability to switch strategies to a pay off strategy if you choose to do so.

If you do qualify for PSLF in 10 years then great. You don’t have to pay the tax anymore, you have a large sum of money you’ve saved, and you no longer have student loans.

To figure out what you need to save to minimize the risk, you can use the same calculator. However, you’ll want to use it assuming no public service loan forgiveness. We detail how to do that in our income driven repayment calculator.

Implementing Your PSLF Plan

As I mentioned above, the key to public service loan forgiveness is maximizing the benefit while reducing the risk. It goes to the saying I constantly preach in our financial course, manage your risk and your return will be there.

With that in mind, we highly encourage you to save for the IDR tax liability as though PSLF doesn’t exists. You can stay the course by upgrading to FitBUX’s premium membership.

The premium membership calculates a recommended minimum amount to save each month. It will also notify you if you are not saving enough.

Most importantly, when you income changes, if your family status changes, and if tax rates change, then you’ll estimated tax owed will change. Therefore, you can update this information in real-time using are IDR Tax Savings Solution.