When it comes to repaying student loans, income-driven repayment plans are a great option for those looking to reduce their financial burden. These plans provide an affordable way to pay off your student loans while still living comfortably.

However, it is important to understand how these plans work and develop a plan that fits your individual needs in order to get the most out of them.

In this guide, we will discuss:

- How income-driven repayment plans work;

- How you can create a financial plan if you’re using one of these plans; and

- Tips on properly implementing your plan.

With this knowledge in hand, you can make sure that you don’t miss out on any opportunities or incur unnecessary costs when taking advantage of IDR!

The Starting Point: The Different Types Of Income Driven Repayment Plans

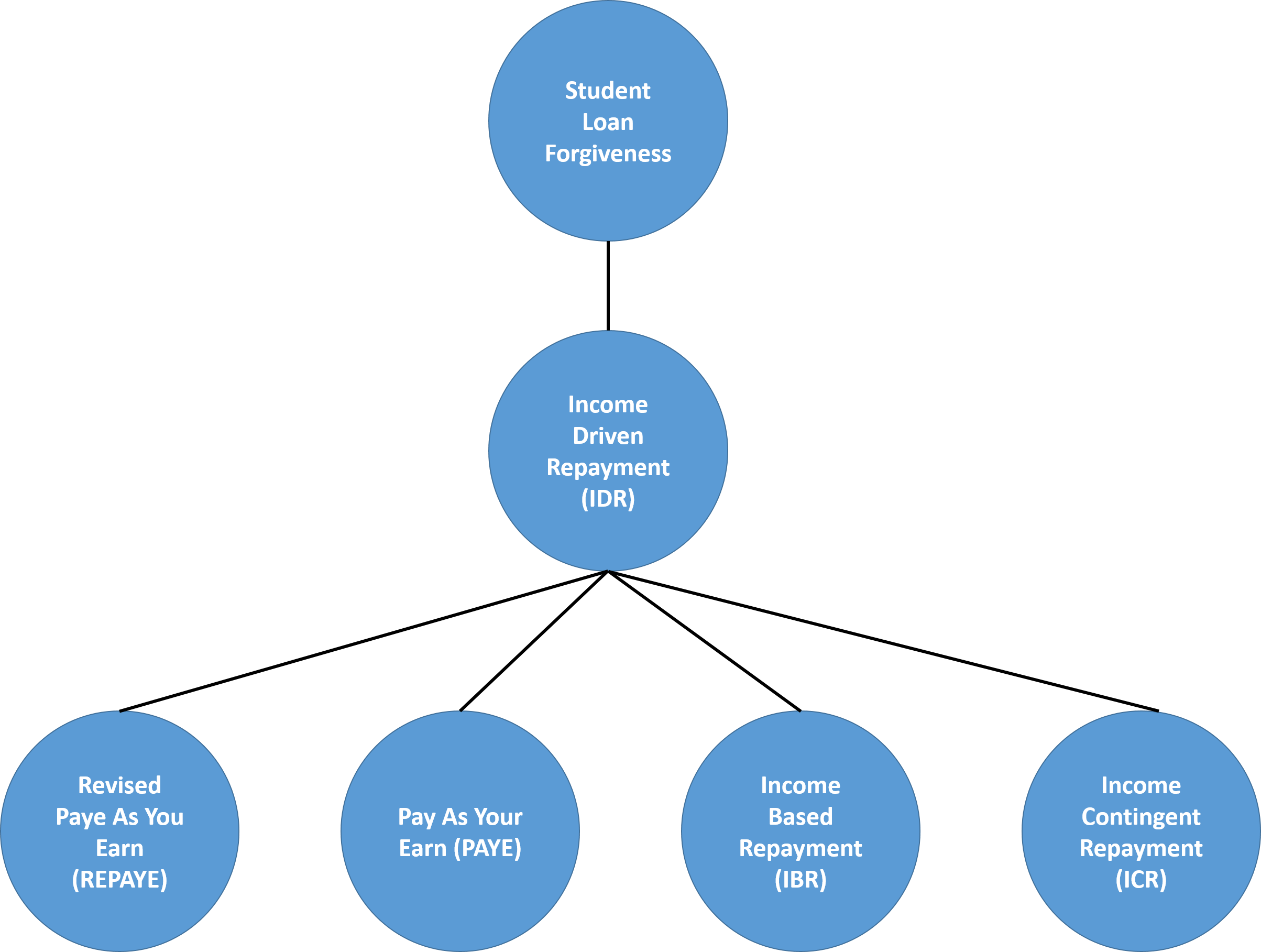

Income driven repayment is a catch all phrase to describe the following federal student loan forgiveness plans:

- SAVE (Formerly known as Revised Pay As You Earn),

- Pay As You Earn (PAYE),

- Income Based Repayment (IBR), and

- Income Contingent Repayment (ICR).

To make federal student loans more confusing, the government has two different versions for IBR; IBR for new borrowers and IBR for old borrowers. On top of that, they are now changing REPAYE to SAVE.

Therefore, there are technically 5 versions of income driven student loan plans.

Due to the confusion these acronyms cause, we will keep it simple in this article. We will use the following terms to mean the same thing:

- Income-driven repayment;

- Income-based repayment; and

- Loan Forgiveness to mean.

Below is a graph that summarizes the relationship among all the acronyms used to describe income-based repayment plans.

What Type Of Federal Student Loans Can I Repay Under An Income Driven Repayment Plan?

Income driven repayment is only available to Federal student loan borrowers. They are not available for private student loans.

There are many nuances to which loans qualify. In short, if you have a direct loan or federal direct consolidation loans then you will qualify.

Loans that don’t qualify are PLUS loans made to parents (Note: Parent PLUS loans may qualify using the Double Debt Consolidation loophole).

You Must Understand Income Driven Repayment Plans To Avoid Catastrophe

The following story illustrates what 80% of new grads using an income driven repayment plan do.

Let us assume as a new graduate you are told your monthly payments on a standard 10 year repayment plan is $750 per month. Based on your financial circumstances, that may be unaffordable.

Therefore, you call your loan servicer and they tell you about this awesome plan whereby:

- Monthly payments would only be $150 per month.

- Your payment would be tied to your adjusted gross income. Therefore, if your income goes down so does your payment. Thus, your payment is always affordable.

- THE KICKER.…at the end of 20 or 25 years, whatever you still owe is forgiven by the government.

Most jump at this because their federal student loan payments are so low. However, they don’t realize that the loan servicer has to “recommend” the plan with the lowest monthly payment by law!

This results in many borrowers choosing the wrong repayment plan for their federal student loans or being blind sided a few years later once they find out the details.

Therefore, you need to know the details upfront which I explain below.

How Is Your Monthly Payment Amount Calculated Under An Income Driven Repayment Plan

Monthly payments on income driven repayment plans are based as a percentage of your income. Currently, that percentage is 5%, 10%, or 15% depending on the plan.

To estimate your monthly payment amount, simply take the percentages above and multiply it by your gross income.

This is an estimate and will work if you are trying to keep it simple.

However, the actual calculation for your payment is much more complex.

It is based on your Adjusted Gross Income (AGI). If you’ve been looking into these plans, you may have heard this term referred to as discretionary income or taxable income.

In addition, it factors in your family size and the poverty rate. The bigger your family the lower your loan payment.

One more important characteristic to know about your loan payments is specific to married borrowers. Your monthly student loan payments can be based on joint income if your married and will vary based on how you file your taxes.

Calculating monthly payments on IDR can be difficult. Therefore, we recommend using an IDR calculator such as FitBUX’s that takes this information into account.

Where The Income Driven Repayment Plan Gets Ugly

You are charged interest on your student loans each day. This is called the interest charge.

Add the daily charge over a month and you’ll get your estimated monthly interest charge.

In most cases, the loan payment on an income driven repayment plan is lower than the monthly interest charge.

When this happens you defer interest. In short, you have unpaid interest your remaining loan balance goes up!

Below is an example:

- Your interest charge is $1,100 per month

- The required monthly payment is only $500

Your remaining balance will increase each month by $600 ($1,100 – $500).

This will continue to happen as long as your loan payment is lower than your interest charge. Or stated another way, you only stop deferring unpaid interest if your adjusted gross income increases to a point that makes your monthly student loan payment greater than your interest change.

Note: SAVE is calculated slightly different due to an interest subsidy. There is no interest deferral.

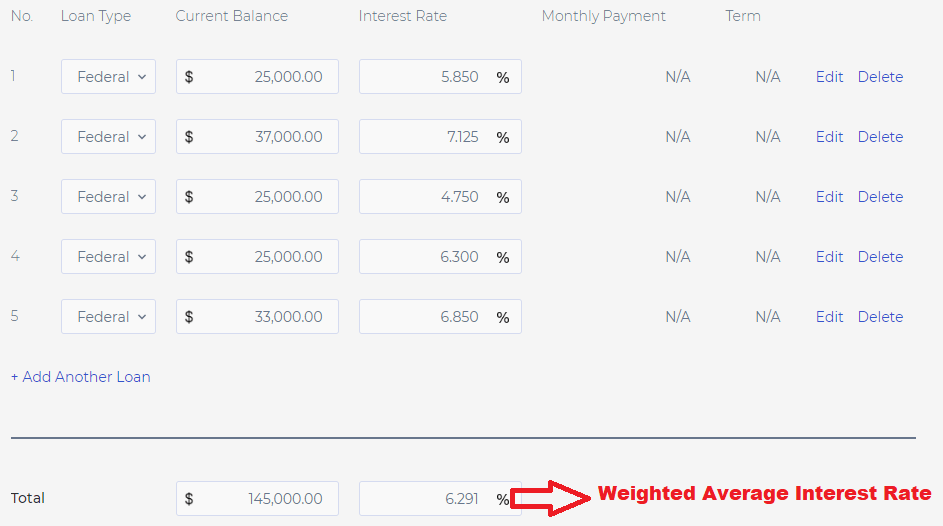

Calculating Your Monthly Interest Charge

Here is how to calculate the estimated monthly interest charge.

- Take the weighted average interest rate of your Federal student loans.

- Multiply the weighted average interest rate by the total balance that you owe.

- Divide the result by 12.

- This result is your estimated monthly interest charge.

The picture below is an example from a FitBUX member’s profile.

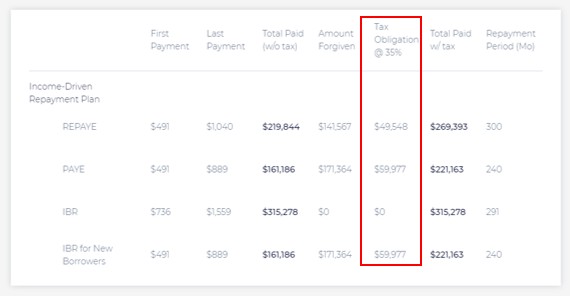

Income Driven Repayment Plan Terms & The Tax Bomb!

Income driven repayment plans have terms of 20 or 25 years. At the end of the term, the entire amount you owe is forgiven. This part is easy.

You have to claim 100% of the forgiven amount as income the year it is forgiven. Therefore, you must pay the associated income taxes on it.

The amount you pay income taxes on includes both the original amount you owed plus the unpaid interest in addition to the borrower’s income in that tax year!

You have to understand how much you will owe, plan for it, and have a way to implement your plan. I dive more into each of these next.

Calculating The Tax Bomb

The primary data you need to project include your adjusted gross income, tax rates, inflation, income and family size.

In addition you’ll have to know all the small nuances of each repayment plan.

Long story short, you’ll want to us an income driven repayment calculator such as the one at FitBUX to do these calculations for you.

How Much To Save

Your goal will be to save a portion of your annual income for the tax.

I’m going to illustrate how much to save by using an example.

Let’s assume your estimated tax liability is $65,000.

You need to calculate a minimum to save each month that grows to equal your tax when the loans are forgiven. We call this monthly amount your recommended minimum monthly savings amount.

For example:

- You can earn 2% per year on the savings until the date you have to pay your tax obligation

- Based on FitBUX’s calculations, you save $220 per month for the next twenty years.

Assuming you start putting money aside as soon as you enter an income driven plan, you’d have $65,000 saved in twenty years for the tax.

Therefore, you can think of your repayment plan as your monthly payment amount plus the amount you are saving for the tax.

How To Save

As mentioned earlier, these plans last either 20 or 25 years. That is a long time and a lot can change. Therefore, you have to have a sound saving and repayment plan.

One way to establish a solid plan is to open a dedicated account which will be used only for your “IDR Tax Money”.

This could be a savings account at your current bank, an online savings account, a Roth IRA, or online investment account.

As a note, if you’re married and file separately so you can get a lower monthly payment, then you have to do a backdoor Roth IRA.

Then set-up a monthly auto-deposit for your minimum recommended savings amount (or more).

Most importantly, after you set that money aside, treat it as though it doesn’t exists anymore. The only time you take the money out of that account is to pay your tax (unless you have a major, major, major emergency).

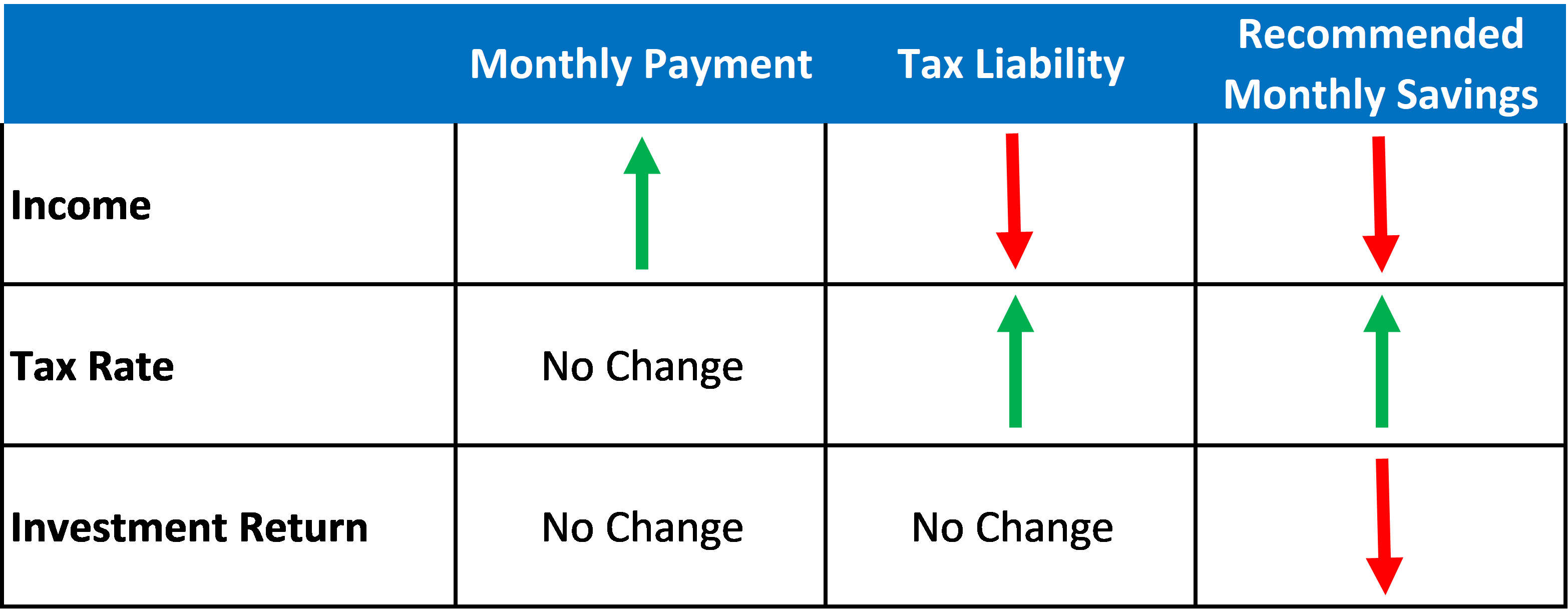

Assumptions That Change The Tax Liability

A lot can change over 20 or 25 years.

The important item to remember is that your estimated tax liability will change over time. Thus, how much you need to save each month will change over time.

You can’t simply start saving your initial recommended savings amount each month and forget about it.

Below are the three common items that change the tax liability that you need to be aware of:

- Your discretionary income: Your income will not grow by the same amount every year. In fact, there may be a few years were you don’t work at all! Conversely, you may get a new job or a promotion. This impacts your monthly loan payment which in turn impacts the tax you’ll ultimately owe.

- Your family size : Marriage and children will change your monthly loan payment. You will have to account for your spouses’ income, their federal student debt load, and a change in household size when you have children.

- Tax rates: Long story short, nobody can predict what the rate will be in 20 or 25 years but they will change.

- Marriage: When you are married, filing separately vs jointly will greatly effect your payment and your tax liability.

The only way to mitigate these risks is to save.

How Does Saving Mitigate The Risk?

A lot in your life can change over 20 – 25 years. Things like your income and family size can change drastically.

If you save for the tax liability and everything goes exactly as planned then great, you will be prepared.

However, what if it doesn’t go as planned?

For example, let’s say you get married and your spouse has a high discretionary income with no student debt.

In this scenario, you may no longer benefit from income driven repayment because of the increased loan payments triggered by the additional income.

If you are saving for the tax and this happens to you, then you can simply modify your approach and pay off your loans. You can take all the money from your tax savings account and use it to make a large prepayment on your loans instead.

Thus, you put yourself in a win-win situation regardless of what happens in your life.

How Do I Qualify & Apply For An Income Driven Repayment Plan

Direct loan borrowers or those with direct consolidation loans qualify.

What does your discretionary income have to be to qualify? Technically any qualifies. However, the higher your discretionary income is the less reason you have to us these plans because you loan payments are going to be high.

Step one in applying is to submit your income information. You can do this by submitting your paycheck or using the IRS data retrieval tool. The IRS data retrieval tool sends your tax data to the loan servicer and is the most popular method.

In addition, if you are married you’ll have to decide if you file taxes separately and use only your income or jointly and use both incomes.

The second step is to recertify your income each year which means you’ll need to repeat step one each year. Things like your income and family size will change. Therefore, the government will change your monthly loan payment once a year.

The biggest mistake people make is not recertifying. If you don’t do this, you will be kicked off of the income driven repayment plan. When this happens, the interest you deferred is “capitalized”. In short, the interest you had deferred will now be charged interest as well and your tax bill at the end will increase.

Also, there are three primary assumptions that go into projecting your tax liability:

- Your discretionary income,

- Family size, and

- Tax rates.

If one of these three items changes, you need to reevaluate your situation immediately.

Below illustrates how these three items affect your tax liability and the the recommended monthly savings amount.

How to read the following chart: If my income goes up, then my required payment goes up, my tax liability goes down, and my recommended minimum monthly savings amount goes down.

If the tax rate goes up, my monthly payment does not change, my liability goes up, and my recommended monthly savings amount increases.

If the return on my investments in my tax savings account increases then my monthly payment and liability are not changed. My recommended monthly savings amount decreases.

Income Driven Repayment and Student Loan Refinancing

When you refinance your Federal loans, you go from a Federal loan to a private student loan. Private loans do not qualify for student loan forgiveness! Therefore, DO NOT REFINANCE THEM.

If you have a combination of Federal loans and private loans, then refinance the private loans only.

Public Service Loan Forgiveness

Many people get confused about Public Service Loan Forgiveness (PSLF). They think it is a repayment plan. However, it is not. It is a feature of income driven repayment plans.

This means this entire guide applies to PSLF as well.

However, you have additional items to consider if you are pursuing PSLF.

For example, after you make 120 qualifying payments your loans are forgiven with no tax.

Qualifying payments means you work at a non-profit full time and you make your loan payments on time.

FitBUX’s Income Driven Repayment Plans Survey

We’ve helped many young professionals develop their repayment plan. I continue to be astonished at the lack of understanding and planning around income driven repayment plans.

Specifically, the lack of understanding when it comes to the tax implications.

Here are a few mind-bogging quotes we’ve heard:

“My school had someone come in to talk to us. He basically told us we are all stupid if we don’t use an income driven repayment plans. That is really all I know about them.”

“What do you mean there is a tax?”

“I wasn’t aware that my payment wasn’t enough to cover the interest so my loan keeps getting bigger and bigger.”

“Financial aid didn’t tell me anything nor did my loan servicer. I only know about the tax because of a FitBUX student loan workshop I attended.”

We kept hearing quotes like these so we decided to put some numbers around it. We surveyed approximately 550 young professionals including physical therapist, occupational therapists, physician assistants, physicians, dentists, lawyers etc…,

As we discussed above, the tax liability is a big component of these plans. Yet, 88% don’t know about it (those answering ‘What are IDR plans’ and ‘No, I wasn’t aware of it’). This is a ticking time bomb to put it mildly.

More Data About Income Driven Repayment Plans

We’ve gathered other data points based on FitBUX’s proprietary research.

Thanks to our uniquely targeted set of data gathered from our Members and other surveys we’ve done for FitBUX Articles, we’re able to provide unique insights into the student loan crisis. Below are a few examples as to why the lower monthly payments of income-driven repayment plans are so appealing:

- There are plenty of reports indicating that more and more recent graduates elect to move back home after graduation. One of the main reasons cited is the need to save money and use this “rent money” to pay off their student loan. To put things in perspective, 37% of FitBUX’s Members have moved back home post-graduation.

- Financial institutions heavily rely on an applicant’s Debt-To-Income ratio to assess his/her financial health. At FitBUX, we like to go a little bit deeper when it comes to student loans and use a Student Debt-To-Income ratio (SDTI) to quantify the student debt load of our members.

- The median gross income for all FitBUX members is $65,000 ($58,000 average) with an median of $121,000 in student debt.

- If one were to stay on the default 10-year plan to pay off that student debt and a 6% interest rate, the required monthly payment would be $1,343. Using the median gross income above, this represents 24.5% of gross income.

When trying to answer “is going to college worth it?, the recommended SDTI ratio is 15% or less, using a traditional 10-year plan. To stay within these recommended ratios, this means that someone making $65,000 should have $75,000 in student debt at most….

Rapid Fire Questions & Answers About Income Driven Repayment

What are the disadvantages of income driven repayment plans?

The two primary disadvantages are interest accrual (your loan balance will most likely increase) and the tax that is owed when the loans are forgiven.

How do income driven repayment plans work?

Payments are based as a percentage of your discretionary income, marriage status, and family size. Most will differ interest. After a given time the loans are forgiven. At that point your remaining loan balance that is forgiven is taxed.

Can you make too much money for income driven repayment plans?

No. However, on IBR and PAYE you must have a partial financial hardship. This means your discretionary income is low enough whereby your income driven payment is less than the 10 year standard loan. If you are on REPAYE there is no cap to your monthly payment.

Is using an income driven repayment plan a good idea?

This all depends on your understanding of these plans and your personal situation such as your family size. What is good for one person maybe bad for another.

How long do income driven repayment plans last?

20 years, 25 years, or if your balance on your loans hits $0 before those time periods. Also, if you qualify for PSLF then they can be finished within 10 years.

Will income driven repayment plans hurt my credit score?

Directly no. Indirectly, maybe as you still show a large loan balance. Also, it may be hard to qualify for a mortgage.

What is the difference between income driven, income based repayment, and income contingent repayment?

Income based repayment and income contingent are types of income driven repayment plan. Income driven repayment is a catch all phrase the government uses to describe 5 different repayment plans.

Is PAYE better than IBR?

If you are on an income based repayment plan for old borrowers, yes. However, you may not qualify for PAYE. In regards to IBR for new borrowers, PAYE and IBR are the same exact thing.

What is the best income driven repayment plan?

It depends on what you qualify for and your personal financial situation. I highly recommend speaking with one of our expert Student Loan Planners for free.

Should I switch From IBR to REPAYE?

You may not be able to because your loans don't qualify. If that is the case you have to do a direct consolidation loan and 90% of the time its not worth it if that is the case. Also, it depends which income based repayment plan you are on (IBR or IBR for New Borrowers).

Does interest accrue during income driven repayment?

If you interest charge is greater than your monthly payment, yes!

Do I have to include my spouse's income?

It depends what plan you are on and how you file your taxes. On REPAYE it doesn't matter, they automatically use both incomes to determine your monthly payment. This may change soon if Biden's new REPAYE plan passes.

How do I reduce my IDR monthly payment?

Contributing to a pre-tax retirement account is the easiest way to do this.

Does income driven repayment get forgiven?

Yes. After 20 or 25 years of on time payments you qualify for loan forgiveness. However, you will have to pay taxes on the amount that is forgiven.

How long does it take for the application to process?

This varies by loan servicer. However, 2 – 4 weeks should be the max.

Conclusion

Income driven repayment plans can be a great tool to help manage student loan debt, get the lowest monthly payment and qualify for loan forgiveness. However, it is important to understand the details of each student loan plan before making any decisions.

With FitBUX’s financial planning technology, we make it easy for students and new grads to decide if using an income driven repayment plan is right for them.

Our student loan planning experts has already helped new grads manage and eliminate over 1 billion dollars in student loans.

So don’t hesitate – take advantage today and see how you can start paying off your student loan debt faster with an income driven repayment plan that fits your needs.

By Joseph Reinke, CFA, Founder of FitBUX