FitBUX members have access to our student loan payoff calculator as part of our free membership. Its customized to you!

Therefore, members on average save $3,000-$5,000 with a simple tweak in their payoff plan by using our student loan payoff calculator.

Other payoff calculators ask you for one lump sum student loan with a singular interest rate. Thus, they can’t show you these savings because you have multiple student loans with multiple rates.

FitBUX’s student loan payoff calculator asks you to list out each loan with their specific interest rates.

For example, you may have $120,000 in student loans, but you still may have 10 separate student loans each with a different interest rate.

Our payoff calculator then allows you to allocate prepayments so you can pay off the loans fast. The faster you pay them off the more you save.

With our financial planning technology, you can even decide if you want to pay off the high interest rate loans first or the low balance loans!

Below I will show you how to use our student loan payoff calculator as well as illustrate student loan repayment using our innovative financial planning technology.

If you are looking for an income-driven repayment calculator click here. Also, if you are trying to decide if you should payoff your student loans or use IDR, build your profile and schedule a free call with a FitBUX Coach.

One last point to make. If you are paying off your loans, be sure to look into refinancing them to see how much money you could save.

How To Use Our Student Loan Payoff Calculator

Step 1

Become a member of FitBUX by creating an account. Creating an account is what powers the customized results of the payoff calculator.

The student loan payoff calculator is free but you will need to have an account to gain access.

Step 2

In order to take advantage of this payoff calculator you will need to input all of your student loans into your profile.

If you didn’t already do this, THIS ARTICLE will explain how you can do this. (Note: The Accounts tab in the article will now be under ‘My Profile’ and then you’d click on ‘Accounts’.)

Also, you can sign up for our premium membership and link your student loans to your FitBUX profile. This will auto populate your student loan data.

Step 3

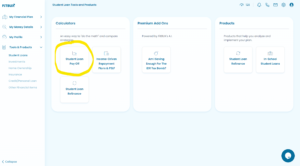

Once all of your student loans are in your profile, you’ll want to click ‘Tools & Products’ on the left-hand side. 6 options will drop and you will now click on ‘Student Loans’. Click on the very first calculator in the left column titled, “Student Loan Pay Off”.

Step 4

You will now see all of your student loans with the specific interest rate listed for each. On this screen, you can either simply click ‘Next.’

If you want to change the term length for your student loans, you can do that as well and it’ll readjust your monthly payment.

Step 5

Once you hit ‘Next’, you’ll come to a screen that lets you add in these extra prepayments so you can see how quickly you can pay off your loans.

Step 6

Click on ‘View Strategies’ and now you’ll see the output.

Scroll down to see details such as how much you’re spending over the years and how quickly you’d pay your loans off.

Using Our Financial Planning Technology

You may be curious how much you could realistically put towards your student loans on a monthly basis when taking into account your budget or future life goals such as buying a house.

Our one-of-a-kind technology will help guide you in the right direction when you’re trying to determine just how quickly you could pay off your loans and gain financial freedom.

Let’s say that you had a goal of buying a house in 3 years. Right now you may be able to pay off your loans in 8 years but once you get the house and all involved with that, maybe it will take 10 years.

Or maybe you think you can only pay off your loans in 10 years, but making a simple budget tweak to save $200 a month could save $30,000 by paying off the loans in 7 years.

As always, if you’d like help setting this up a plan so you can see how much you’d save along with how quickly you could pay off your loans, become a FitBUX member. Need help? Schedule a call and our expert student loan planners will walk you through everything. They can also help you decide if refinancing student loans is right for you or not!

By David Hughes and reviewed by Joseph Reinke, CFA