FitBUX’s financial technology includes a free mortgage payoff calculator that every Member can take advantage of. The mortgage payoff calculator may be used to:

- Find out how much you save by making prepayments.

- Calculate how much a monthly payment will be based on your home price and interest rate.

Below is an explanation of how to use the mortgage payoff calculator so you can take advantage of it appropriately. Use FitBUX’s free financial planning technology to see how making extra payments fits into your financial plan as well as how much home you can afford.

Step 1 – Build Your Profile

To get things started, head over to Fitbux.com and click join now, become a Member for free, and build your financial profile. Doing this step gives you access to our mortgage payoff calculator as well as our other one-of-a-kind financial technologies.

The profile should take 3 – 5 minutes to create. Once you complete the profile, you may also schedule a free call with a FitBUX Coach if you would like to get answers to your questions from a real person!

Step 2 – Accessing The Mortgage Payoff Calculator

From your dashboard, click Tools & Products from the left hand menu. Then select home buying and refinancing. This screen will show you all the home buying and refinancing tools FitBUX has to offer. Click the option saying Mortgage Payoff.

Step 3 – Enter Mortgage Details

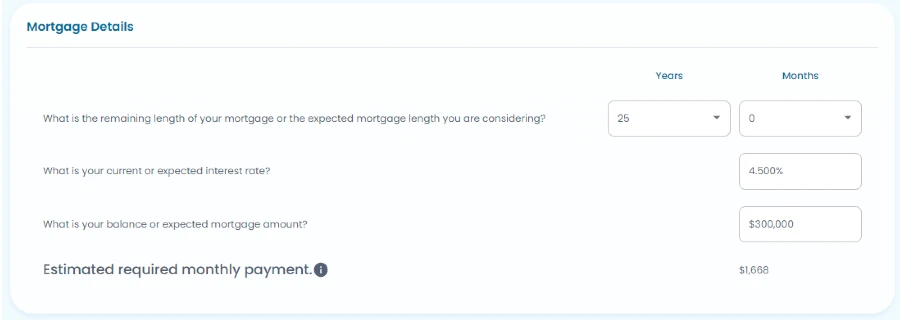

If you already have a mortgage enter the time remaining on it, the interest rate, and the balance of the mortgage. If you entered this information when you built your profile, it will automatically be shown here.

You can also use this calculator if you don’t have a mortgage. If you are using the mortgage payoff calculator to get estimates then enter the length of the mortgage you expect to use (15, 20, or 30 years), the expected interest rate, and the expected mortgage amount. At this point, you’ll see the estimated required monthly payment.

Step 4 – Entering Prepayments

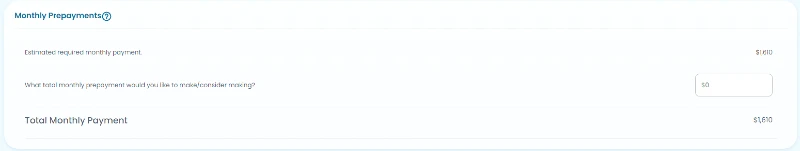

This is the step whereby you can see how much prepayments will save you and how much time they will reduce from your loan.

Enter how much extra you will pay monthly. If you are not going to do so monthly but instead do one extra payment a year or do bi-monthly payments, estimate what the amount would be on a monthly basis. The answer will be very similar.

For example, if you are going to do one extra payment of $1,200 a year, enter $100 a month for an extra payment.

Step 5 – Results

The last step is to hit calculate and see the results.

Conclusion

This mortgage payoff calculator provides everything you need to get started paying off your mortgage. I highly recommend checking out the following resources:

By Joseph Reinke, CFA