In 2008, there were more than 3 million foreclosures. These 3 million households all qualified for a house. As they found out, they couldn’t afford it.

There are plenty of home affordability calculators out there. Unfortunately, they aren’t good.

Instead of telling you how much home you can afford, they focus on what you qualify for. They don’t ask you about other goals, your family situation, your income, your future plans, your work, housing upkeep expenses, etc… These things all factor into home affordability.

Home affordability calculators on popular websites are there to qualify leads for lenders. Thus, they may say home affordability calculator but they aren’t there to truly help you figure out what you can afford.

At FitBUX, we care about you more than we care about lenders.

Therefore, we recently launched two innovative technologies that tell you exactly how much home you can afford. One is our home affordability calculator and the other is our financial planning technology. Both use your FitBUX profile and consider your entire profile such as your debt, income, budget, financial goals, etc…

Below, I detail each of our new technologies and how to use them.

How to Use Our Home Affordability Calculator

Step 1

To get access to our free home affordability calculator, you will need to have a FitBUX premium membership as this specific tool is based on our financial planning AI.

Step 2

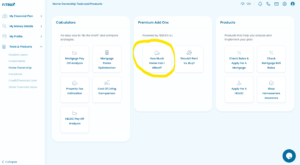

Once you have upgraded your membership, click Tools and Products from the left hand menu. Once you click this, 6 topics will drop down.

Find the one that says, ‘Home Ownership’. In the middle column, the Premium Add-Ons section, choose ‘How Much Home Can I Afford?’.

Step 3

The first thing you’ll be asked to do is to confirm your income as well as your debt. This is important to help determine your cash flow.

However, we do more than just look at cash flow. We take into account the type of income you have because every type of income has different risk characteristics.

Step 4

Next you’ll be asked about the amount of down payment you plan on making. We ask this because we incorporate housing data from your zip code.

How much you plan on putting down on your house reduces how much you borrow. Therefore, the more you put down the more you can afford!

Step 5

The last screen of the home affordability calculator displays how much home you can afford.

The results are displayed as Optimal, Okay, and Risky.

If you don’t have an optimal home price, its because there isn’t a price in that range that is affordable.

Also, if you don’t have amount your can afford or the amounts are low, this doesn’t mean you shouldn’t buy. Your rent may be so high that buying still makes since. For that decision, you’d want to use our rent vs buy calculator or our financial planning technology which I detail below.

Using Our Financial Planning Tech To Determine Home Affordability

Our home affordability calculator is great but only looks at today, assumes you stay in the same location, and doesn’t factor in future life events such as having kids.

Our one-of-a-kind financial planning technology takes into account all of that. In addition, you can run multiple scenarios and determine what is the best route to take.

For example, you can build one plan whereby you are going to have children in 5 years. You also want to pay off your student loans in three years and buy a house in four years instead of buying a house today.

You can build that scenario and see how much home you can afford. The technology will even adjust your expenses after you have children so you can see the impact of home affordability once you have children!

Then you can build a second scenario and change the purchase price of the house.

Maybe you want to make a small change and build scenario whereby you keep renting instead of buying. You can do that and compare results.

You can also do a complex change such as not paying off your student loans and instead using an income-based repayment plan.

The options you in our financial planning technology are endless.

In addition, if you need help building your plan, you can schedule call with a FitBUX Coach and they can answer any questions you have about using the technology or about finance!

Once you build your plan, you can then use the technology to implement so you make sure you meet all your goals.

From there you can begin taking the steps to buy a house.

You can contact one of our lending partners to help you with the qualifying process. Our partners are NeoHome Loans and Movement Mortgage.

Once you know what rates you qualify for you can use our free mortgage point calculator to complete your financial plan and save tens of thousands of dollars.

By David Hughes and review by Joseph Reinke, CFA